MMG Limited (MMG) (Stock Code 1208.HK) today reported its interim financial results for the six months ended 30 June 2015.

Key points

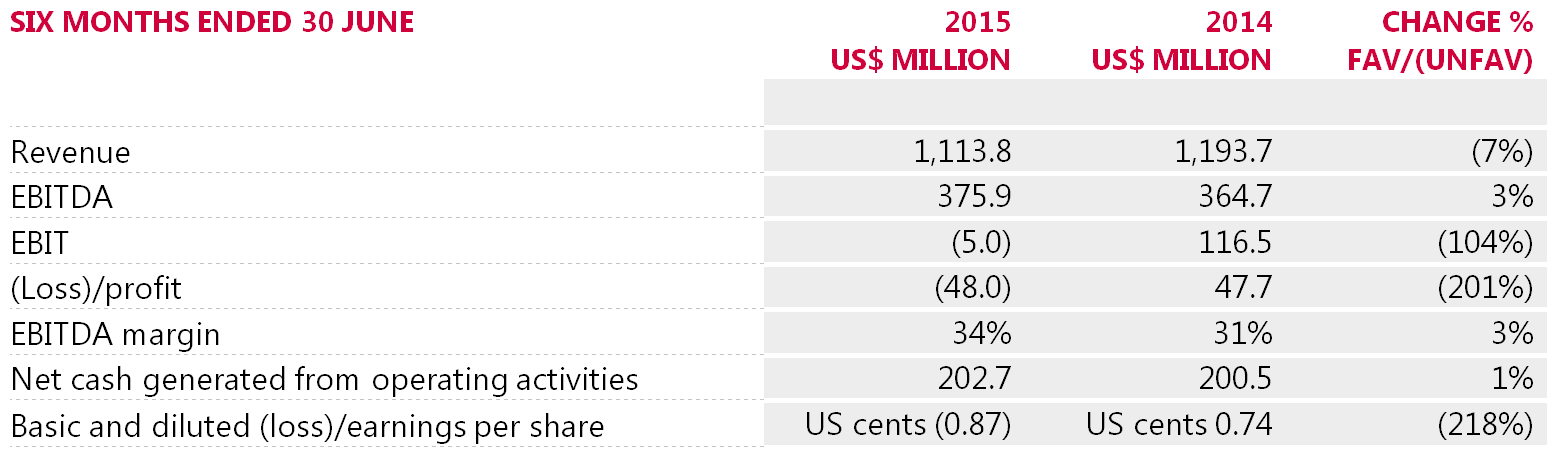

- Strong operating performance and cash generation delivered an increase in Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA) of 3% to US$376 million with an improved EBITDA margin of 34% compared with 31% in the first half 2014.

- Total copper sales volumes 7% higher in the first half 2015 with a production record at Kinsevere.

- Zinc sales volumes 1% higher in the first half 2015 due to zinc focused production at Golden Grove and increased throughput and zinc grades at Rosebery compared to the same period 2014.

- Operating expenses down 9% or US$69 million, other cash expenses down 23% or US$22 million compared to the same period 2014 as a result of ongoing cost focus and favourable Australian dollar exchange rate movement.

- Revenue of US$1.1 billion down 7% compared to the same period 2014, with lower prices impacting negatively by US$156.9 million. Average LME copper prices down 14% on the same period 2014.

- First half profit was also impacted by an amortisation expense of $US94.1 million as a result of the US $146 million increase to the mine rehabilitation provision for Century announced previously as part of the 2014 financial year results.

- Reported net loss of US$48.0 million for the first half 2015, primarily as a result of lower commodity prices and increased depreciation and amortisation expenses mainly at Century.

- Mining completed at Century in August with processing of Century ore stockpiles to be completed in 2015 and Dugald River ore processing to continue through to 2016.

- Las Bambas progress to plan with overall construction progress at 95%, and concentrate related construction 90% complete as of 30 June 2015.

- Management remains confident on the long-term economic fundamentals of copper and zinc.

- The Board does not recommend the payment of a dividend for the period.

Please click for larger version.

Commentary from Andrew Michelmore, Chief Executive Officer:

“2015 is a year of significant transformation for MMG. Our first half results show the capability of our team to deliver in challenging times, while continuing to focus on our growth targets,” said Mr Michelmore.

“Our strong operating discipline and cash generation delivered an increase in EBITDA of 3% to US$376 million and an improved EBITDA margin of 34%, despite lower commodity prices broadly impacting the market.

Safety

At MMG, we remain – as always – firm in our belief that all injuries and incidents can be prevented.

We achieved a further improvement in the Total Recordable Injury Frequency (TRIF) across our operations, with TRIF of 2.0 per million hours worked at the end of June 2015, down from 2.3 at the end of 2014. However, lost time injury frequency (LTIF) rose from 0.4 at the end of December 2014 to 0.5 at the end of June 2015.

Our focus in the second half 2015 is on further embedding our safety culture and making it easier for frontline managers to spend more time coaching for safer outcomes.

Financial performance

While lower commodity prices and higher depreciation and amortisation impacted our first half financial results, we continued to focus on what we can control – productivity and costs.

Driven by our focus on cost reduction and operating efficiency, we achieved a further 9% reduction in operating expenses. This result included additional costs associated with higher sales volumes and was assisted by favourable Australian dollar exchange rates.

Our Operating Model also delivered additional cost savings, with administrative expenses 26% lower during the first half 2015 compared to the same period 2014. Favourable exchange movements and the absence of one-off costs associated with the acquisition and integration of Las Bambas in 2014 also contributed to lower administrative costs.

Revenue for the half of US$1.1 billion was 7% lower than first half 2014, impacted by lower prices for all commodities, except for zinc.

EBITDA increased 3% to US$376 million as a result of strong performance from operations.

MMG reported a loss of US$48.0 million for the first half, primarily as a result of lower prices in addition to an increase in Century’s 2014 non-cash mine rehabilitation costs, and in line with expectations.

Production

Our ongoing focus on asset utilisation and operational excellence continues to deliver, with strong first half copper production and stable zinc production despite the final full quarter of mining at Century.

Total first half copper production of 98,264 tonnes was 6% higher than the corresponding period in 2014, driven by excellent production at Kinsevere and Sepon.

Kinsevere contributed 39,095 tonnes of copper cathode to this total, 17% higher than the same period in 2014. Kinsevere’s first half performance represents a sustained production rate of 130% of nameplate capacity – a ramp-up achieved in just three years of MMG ownership and with no material capital investment.

Sepon also performed strongly during the first half, producing a total of 44,632 tonnes of copper cathode – 4% higher than the same period in 2014. This result was driven by higher mill throughput – demonstrated by the achievement of a quarterly milling record despite the ongoing transition to harder ore types – and supported by further operational improvements.

First half zinc in zinc concentrate production of 286,144 tonnes was 6% higher than the same period in 2014, driven by higher production at Rosebery and Golden Grove.

Despite the transition to lower zinc grades in the final stage of mining at Century, first half production of 221,049 tonnes of zinc was just 1% lower than the same period in 2014.

Zinc production at Rosebery was 40% higher than the same period in 2014, driven by higher mill throughput and higher zinc grades. Golden Grove continues to prioritise zinc with production up 39% to 16,171 tonnes in the first half 2015.

As a result of our first half performance, 2015 copper production guidance has been increased to 171,000 – 186,000 tonnes. Annual zinc production guidance of 440,000 – 510,000 tonnes is unchanged.

Strategy

In a year of transformation, we have made significant progress towards our growth targets.

This is made possible by the strategic insight and financial muscle from our major shareholder and complemented by our international operational competence. We are able to invest in the down cycles and operate successfully in challenging regions around the world.

At Las Bambas – one of the world’s largest copper mines in development – construction is continuing to plan, with the project 95% complete at the end of June. In addition to final construction works, focus is now on project commissioning and operational readiness.

In July, we also took another significant step toward future growth, approving the updated development plan for the Dugald River deposit, in Queensland, Australia. Dugald River will provide MMG with increased exposure to zinc at a time of shrinking global supply with expected annual production of approximately 160,000 tonnes of zinc in zinc concentrate, plus by-products, over an estimated 28 year mine life,” said Mr Michelmore.

Andrew Michelmore

Chief Executive Officer

– Ends –

Media enquiries

English language

Jo Lynch

General Manager Corporate Affairs

T +61 3 9288 0027

M +61 411 208 101

E jo.lynch@mmg.com

Chinese language

Christine Chan

T +852 2801 6090

M +852 6173 9039

Investor enquiries

Peter Budd

Investor Relations Analyst

T +61 3 928 44711

M +61 4 344 34291

E peter.budd@mmg.com

Maggie Qin

Manager China Relations

T +852 2216 9603 (Hong Kong)

T +61 3 9288 0818 (Australia)

M +61 411 465 468

E maggie.qin@mmg.com

Downloads